Teloni per flotte sempre in corsa

Scopri di più

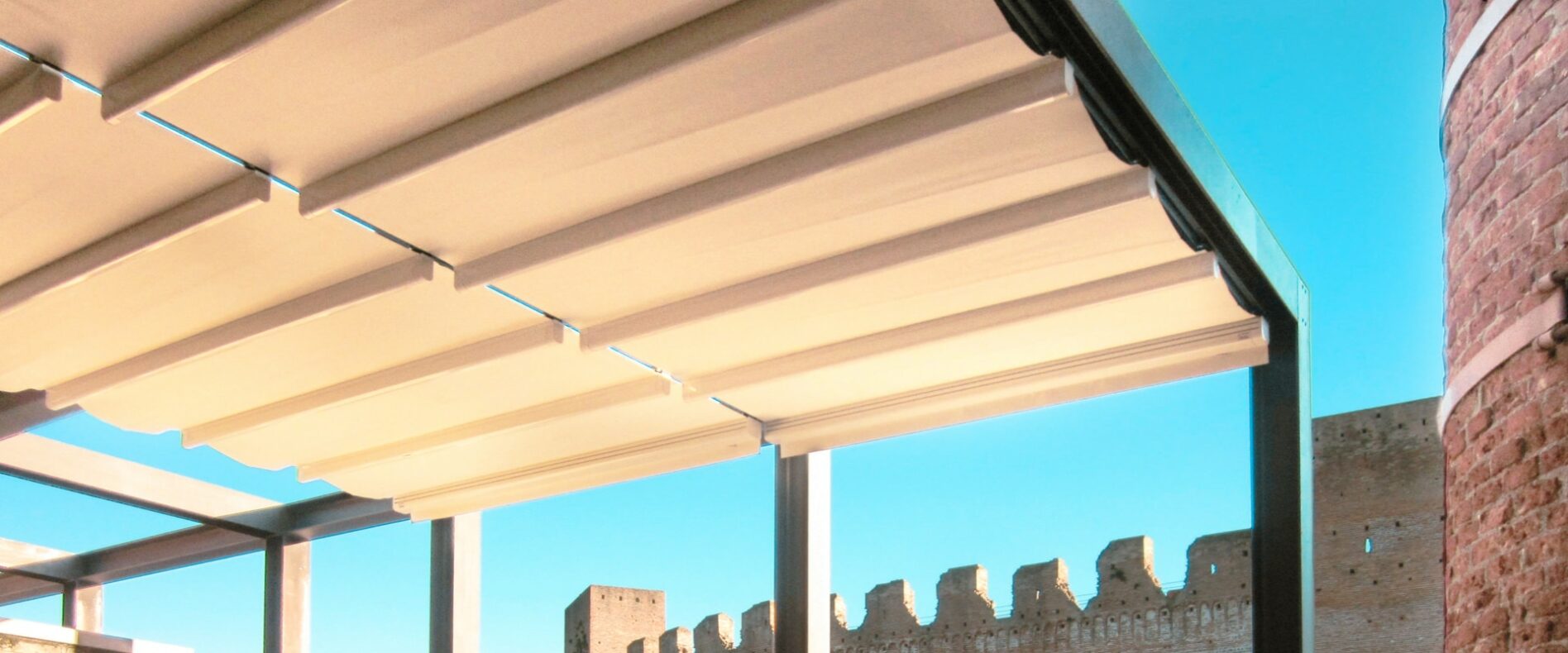

Coperture per automezzi e settori produttivi

Punto di riferimento in tutta Italia per la sostituzione di teloni per automezzi, lavoriamo al fianco delle aziende di trasporto o dei trasportatori per garantire teloni sempre perfetti.

Precisione, Valore e Competenza.

Facciamo correre il tuo business con la stessa passione artigianale che dal 1979 in poi non ha mai smesso di guidarci verso l'innovazione continua.

Velocità, competenza ed esperienza al tuo servizio

Grazie agli investimenti continui in macchinari di ultima generazione e allo sviluppo di un processo produttivo integrato e intelligente, garantiamo risultati eccellenti in tempi rapidi. Tutti i nostri teloni sono completamente personalizzabili sia nell’estetica sia nella funzionalità e offrono le massime prestazioni in termini di sicurezza e affidabilità.

Ci hanno scelto